Going Abroad? Let

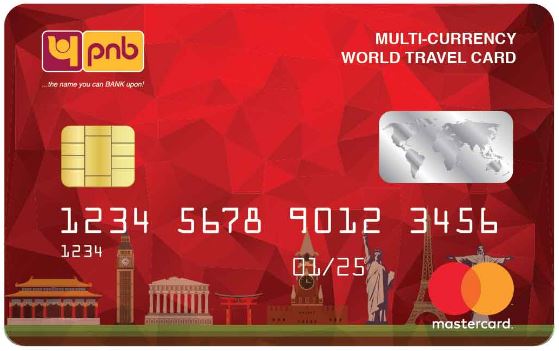

PNB Multi-Currency World Travel Card (MCWTC)

(a prepaid foreign currency card)

We are offering Prepaid PNB Multi Currency World Travel Card which is available to you in USD, EUR, GBP, AED, CAD & SGD. This card does away with the need for carrying Traveler Cheques and Currency. It has several major advantages over other types of cards.

-

1. One Card – Multi Currency

-

2. Dedicated Customer Portal offering many facilities like:

-

a. Dynamic monitoring of Transactions

-

b. PIN can be set at ease

-

c. Enable/Disable option along with Card Transaction limits can be set for ATM/E Com/POS/Contact less

Customer portal Link: https://prepaid.cardservices.in/nconeportal/PNB/html

-

Your exposure to foreign currency is decided on the day the card is issued/ topped up and therefore you are protected against future currency fluctuations in the currency of issue.

-

You do not need to look around for money changers and pay their transaction charges in a foreign country.

-

In case of loss of card, you can immediately lock/unlock the card in the Customer portal provided.

-

In the unlikely event of loss & subsequent misuse of your card, we are insuring loss up to Rs.3.50 lakhs..

-

The unspent balance can be surrendered.

-

Your card can be reloaded for any number of times within your entitlement.

-

We invite you to be a user of this card. All you need to do is to submit an application form along with copy of your KYC documents, Passport, your latest passport size photograph (If you don’t have any account with PNB: Card may be issued against cash for an amount below INR 50000 only) and Form A-2 (in case of amount exceeding USD 25000).